Competitiveness analysis on Viet Nam tourism in relation with ASEAN countries at present

Abstract:This paper aims at analyzing aspects that are affecting the competitiveness of Viet Nam tourism in relation with other Southeast Asia (ASEAN) countries. The issues to be addressed are as follows: (1) the international tourist market share of Viet Nam in ASEAN; (2) Vietnam’s position in competitiveness ranking by the World Economic Forum (WEF); (3) Effectiveness of tourism in Viet Nam in relation to ASEAN countries.

Keywords: ASEAN tourism, Viet Nam Tourism, Competitiveness

1. Introduction

It is a positive year of 2017 for the economies of Southeast Asia. For the first time in four years, the countries’ average growth rate is 5% higher than it was in 2016. As the establishment of the ASEAN Economic Community, the contribution of tourism to their national income has increased. Statistic shows that Japan, Korea and China are the top source markets (ADB, 2017, p.69). Tourism has created many jobs and become a driving force for the economic development of ASEAN countries. According to the WEF’s Travel and Tourism Competitiveness Report, most ASEAN countries are ranked over the 50th out of more than 130 countries surveyed, which reflects that the regional countries focus on tourism development.

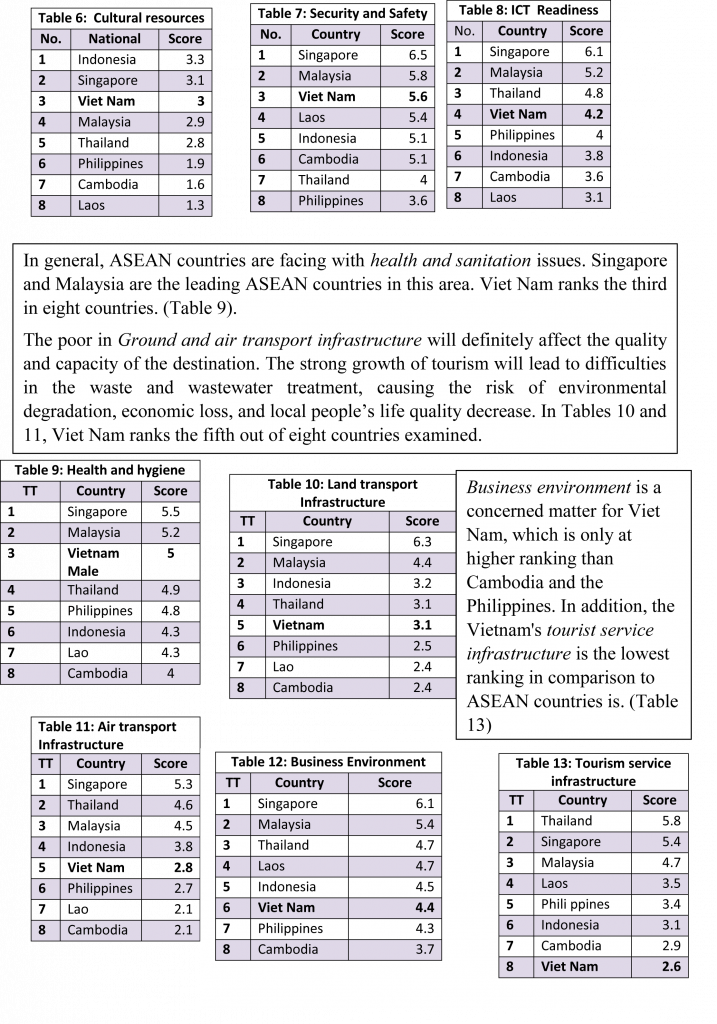

One of the strengths of the region’s destinations is their reasonable tour prices. According to the cost of living, the most affordable ASEAN destinations in the world are led by Cambodia, Indonesia and Vietnam. In addition, the region benefits from having top hotels at competitive prices in China, Indonesia and Malaysia for less than 100 USD/ night. This price competitiveness is quite impressive in comparison with such high-income neighboring destinations as Japan, Singapore, and South Korea. However, many ASEAN countries are facing the gaps in infrastructure development, including air, road and tourism facilities and ICT readiness. In addition, regional countries that encountered political instability reduced their competitiveness in safety and security index (WEF, 2017, p.15).

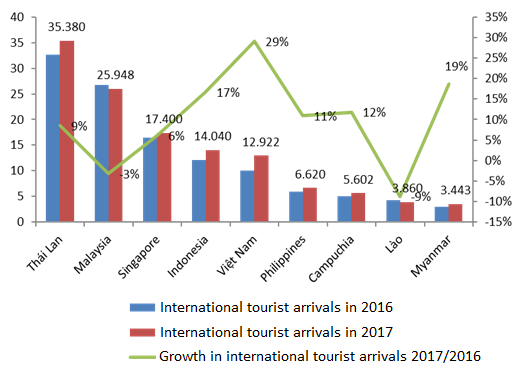

In terms of international tourist arrivals from 2015 to 2017, Viet Nam witnesses the highest average growth of 29% per year, followed by Myanmar (19%/ year), Indonesia (17%/ year), and Thailand (9%/ year). In 2017, Viet Nam ranked the 5th among ASEAN countries with 12.9 million international tourists. However, it only accounts for 37% of Thailand’s share (35.38 million), 50% of its share of Malaysia (25.95 million), 74% compared to Singapore (17.40 million), and 92% in comparison with Indonesia (14.04 million) in terms of the total international arrivals. (Figure 1)

Source: VNAT’s summary from ASEAN National Tourism Organizations

Thus, we assess the competitiveness of Vietnam tourism among ASEAN countries in the below described aspects.

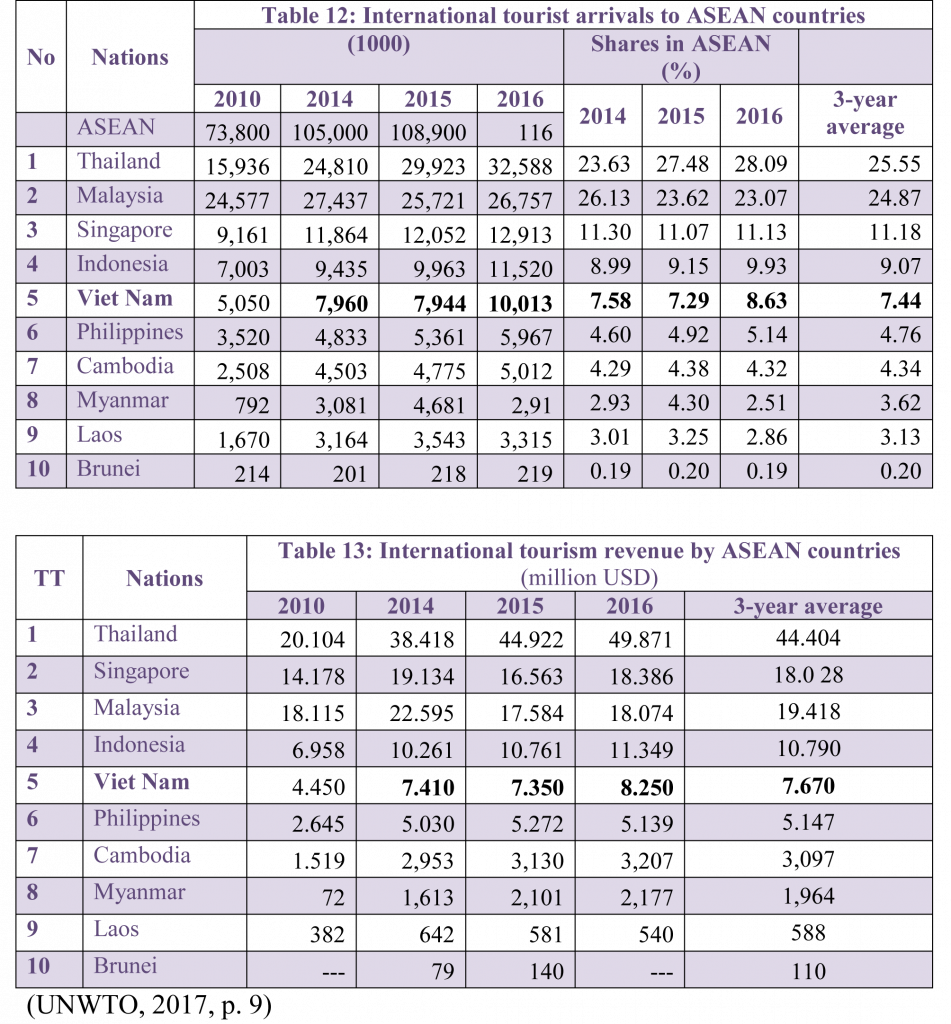

2. The international tourist market share of Viet Nam in ASEAN

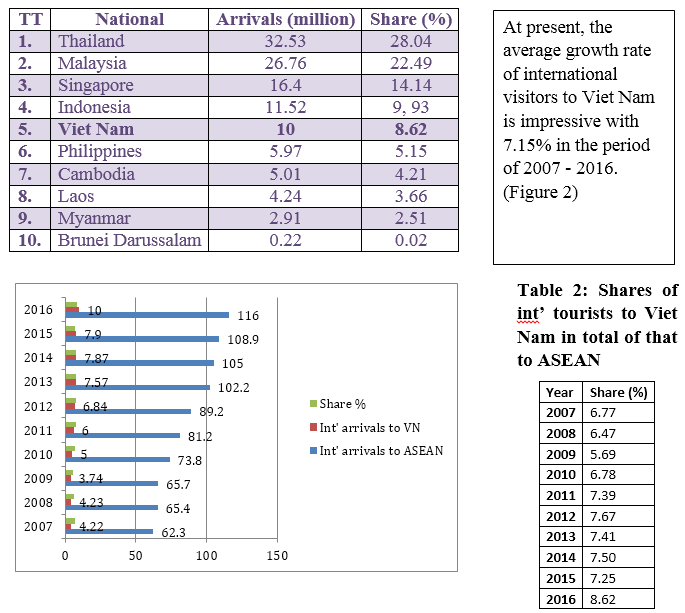

In 2016, the total number of international tourist arrivals to ASEAN is 116 million. Table 1 shows that the five countries which receive less international tourist arrivals are the Philippines, Cambodia, Laos, Myanmar, and Brunei Darussalam. Viet Nam ranks the 5th among ASEAN countries, accounting for 8.62% of international tourist arrivals. The destinations that have steady growth in the region with the largest tourist market shares in 2016 are Thailand, Malaysia, Singapore, and Indonesia.

Table 1: International tourist arrivals in comparison to it is in ASEAN region

3. Viet Nam’s position in the competitiveness ranking by the World Economic Forum (WEF)

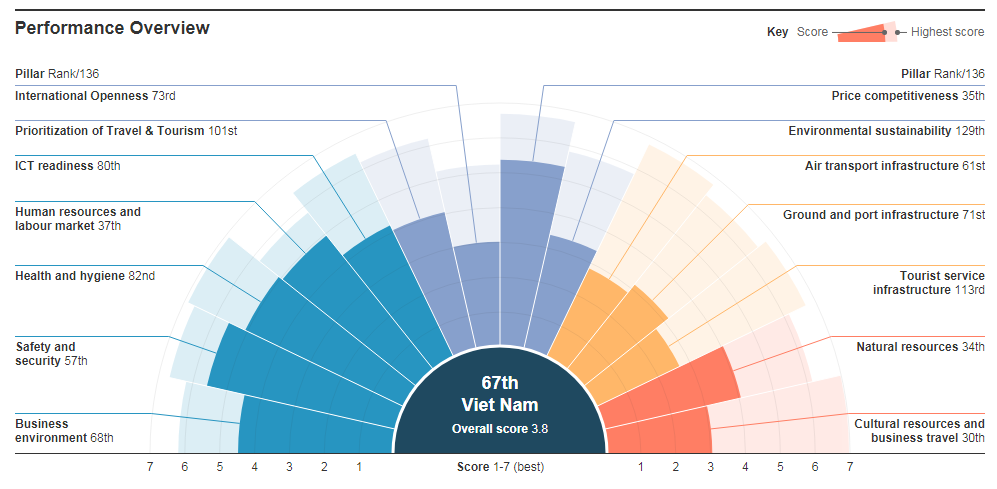

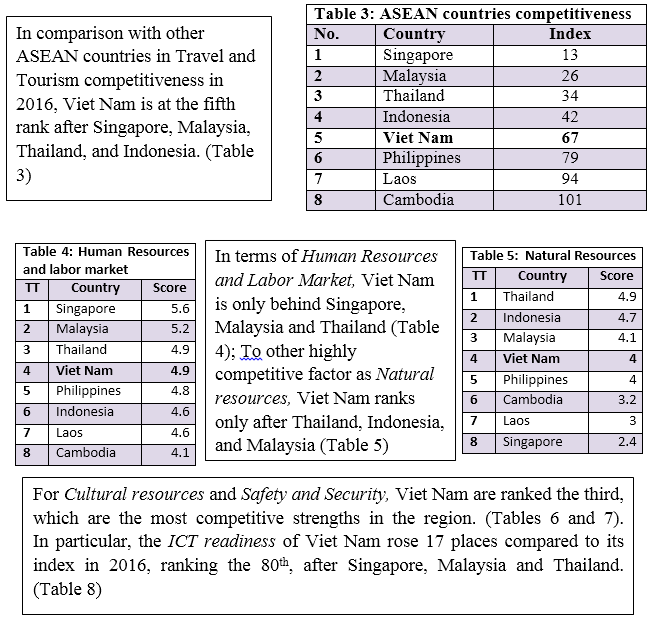

According to WEF, the 2017 competitiveness index of Viet Nam increased 8 places, ranked at 67th out of 136 surveyed countries (in 2016).

4. Viet Nam tourism performance in relation to ASEAN countries in terms of important market segments (marine, urban, culture and eco tourism)

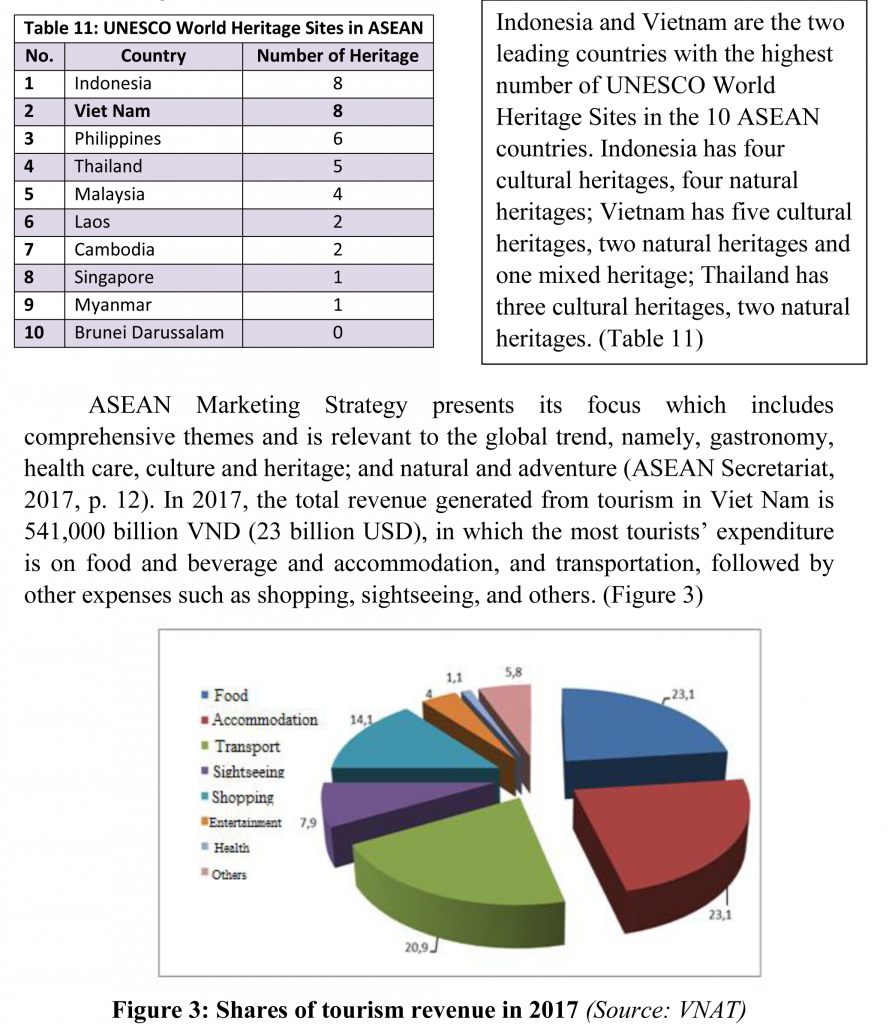

Tourism benefits from the natural and cultural destinations, including the World Heritage sites.

In the past four years, Thailand witnesses the most impressive growth in terms of international visitors, which surpassed Malaysia by 2015 and 2016 with the annual increases of 20.6% and 8.9% respectively. In particular, although Thailand is not completely in outstanding role to Malaysia in terms of arrivals, it generated higher revenue compared to Malaysia and Singapore, being the regional leading destination with nearly 45 billion USD in 2015 and 50 billion USD in 2016. Though Viet Nam ranked at the 4th place in terms of tourist arrivals, it takes the 5th position on the revenue list and only covers 16.54% in comparison with Thailand in 2016. In the period of 2014-2016, Thailand accounts for major share of visitors of 23.6%, 27.45% and 28.10% respectively compared to the region. The average rate of 3 years is 26.38%. At the same time, the number of international visitors to Vietnam in ASEAN was 7.58%, 7.29% and 8.63% respectively. The 3-year average is 7.83%, which covers 29.7% to Thailand’s. (Table 12, 13)

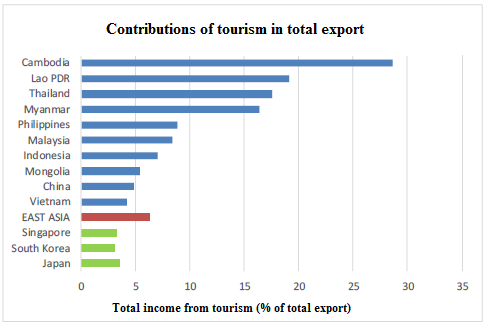

To most countries in ASEAN, tourism is one of the main on-spot export sectors and the main source of foreign currencies. Cambodia is a leading country which generates high-income from international tourists, accounting for 29% of the total national export income value in GDP. The total contribution of tourism in GDP of Indonesia is 6.2%.

5. Conclusion:

Based on the above analysis of tourism competitiveness and performance, the conclusions are as follows.

Although Cambodia, Myanmar, and Laos achieved the average growth rate of 4.3%, 3.6% and 3.1% in terms of international visitors for three years inclusively, the number still accounts for only a small fraction in the region. The Philippines and Indonesia are the two closest competitors to Viet Nam with strong growth both in terms of volume and revenue. Though the Philippines is currently ranked below Viet Nam, the potential, opportunities and the diversity of tourism development and products are not less competitive. According to the World Bank updates on tourism development in developing countries in East Asia, in Viet Nam, the number of domestic tourists is four to nine times higher than that of international visitors. Nevertheless, this number is 25 times in Indonesia, and 50 times in the Philippines (World Bank Group, 2017, p. 89). Though Viet Nam witnessed the positive growth in tourist arrivals in the past two years, it is still behind other tourism developed countries in the region such as Thailand, Malaysia and Singapore in terms of absolute numbers of visitors and revenue. Indonesia has a slightly higher number of tourist arrivals than Viet Nam, but its revenue is considerably higher than Viet Nam.

The issues that Viet Nam tourism facing to in the situation of rapid tourism growth is the infrastructure and tourism facilities, as it has to ensure the sustainable development when Vietnam ranked the 8th out of eight countries are reviewed in tourism infrastructure (WEF). In addition, the ground and air transport infrastructure of Viet Nam is also a constraint, requiring a master plan and close coordination between the tourism and the transport sector. The issue of business and institutional environment which facilitate businesses is still a gap that Vietnam needs to fill in.

In conclusion, many of the advantages of Viet Nam tourism are highlighted by international organizations in ASEAN such as natural and cultural resources, ICT readiness, human resources and labor market for tourism development. In order to maintain the growth momentum and enhance the position of tourism in the ASEAN region, Viet Nam needs to give prioritization to satisfaction of the needs of the key markets, overcoming weaknesses in infrastructure and favorable policies for businesses, improving the environmental quality standards, eco-friendly tourism products and enhancing the participation of local communities in tourism.

References:

- ADB, (2017), Asian Development Outlook 2017, Manila, p. 69.

- WEF, (2017), Insight report “The Travel & Tourism Competitiveness Report 2017”, Geneva, p.15

- ASEAN Secretariat, (2017), ASEAN Tourism Marketing Strategy (ATMS) 2017-2020, Jakarta, p.12

- UNWTO, (2017), Tourism Highlights 2017 Edition, Madrid, p.9

- World Bank, (2017), East Asia and Pacific Economic Update October 2017 – Balancing Act, p.89

Chien Thang

Address: 58 Kim Mã, Ba Ðình, Hà Nội

Address: 58 Kim Mã, Ba Ðình, Hà Nội Phone: (84-24) 37 34 31 31

Phone: (84-24) 37 34 31 31 Fax: (84-24) 38 48 93 77

Fax: (84-24) 38 48 93 77 Email: info@itdr.org.vn

Email: info@itdr.org.vn Website: https://itdr.org.vn

Website: https://itdr.org.vn